- Blank balance sheet helper android#

- Blank balance sheet helper plus#

- Blank balance sheet helper free#

Over 7 million customers use QuickBooks claim: Based on number of global QuickBooks subscribers as of Jan 2020. Over 98% of customers recommended QuickBooks claim: Based on a survey of small businesses using QuickBooks in the U.S. QuickBooks Online mobile access is included with your QuickBooks plan.ġ. Not all features are available on the mobile apps and mobile browser. Devices sold separately data plan required.

Blank balance sheet helper android#

The QuickBooks Online mobile app works with iPhone, iPad, and Android phones and tablets. Tracked Classes and Locations are not available in Simple Start and Essentials.Īvailability: QuickBooks Online requires a computer with a supported Internet browser (see System Requirements for a list of supported browsers) and an Internet connection (a high-speed connection is recommended).

Blank balance sheet helper plus#

QuickBooks Plus includes up to 40 combined tracked classes and tracked locations. QuickBooks Online Advanced includes unlimited Tracked Classes and Locations. Simple Start, Essentials and Plus allow up to 250 accounts. Usage limits: QuickBooks Online Advanced includes unlimited Chart of Account entry. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. QuickBooks Online mobile access is included with your QuickBooks Online subscription at no additional cost. Mobile apps: The QuickBooks Online mobile and QuickBooks Self-Employed mobile companion apps work with iPhone, iPad, and Android phones and tablets.

Blank balance sheet helper free#

You're free to switch plans or cancel any time. Terms, conditions, pricing, special features, and service and support options subject to change without notice.Ĭancellation policy: There's no contract or commitment. The Payroll subscription will terminate immediately upon cancellation.You will not receive a pro-rated refund your access and subscription benefits will continue for the remainder of the billing period. To cancel your subscription at any time go to Account & Settings in QuickBooks and select “Cancel.” Your QBO cancellation will become effective at the end of the monthly billing period. This offer can’t be combined with any other QuickBooks offers. To be eligible for this offer you must be a new QBO and/or Payroll customer and sign up for the monthly plan using the “Buy Now” option. Sales tax may be applied where applicable. If you add or remove services, your service fees will be adjusted accordingly. The discounts do not apply to additional employees and state tax filing fees. There is no additional charge for additional state tax filings in Elite. If you file taxes in more than one state, each additional state is $12/month for only Core and Premium. Service optimized for up to 50 employees or contractors and capped at 150. Contractor payments via direct deposit are $5/month for Core, $8/month for Premium, and $10/month for Elite. Each employee is an additional $5/month for Core, $8/month for Premium, and $10/month for Elite.

Your account will automatically be charged on a basis until you cancel. QuickBooks Discounts: Discount applied to the monthly price for QuickBooks Online (“QBO”) and/or QuickBooks Online Payroll Core, Premium, or Elite (“Payroll”) is for the first 3 months of service, starting from the date of enrollment is free, followed by the then-current monthly list price.

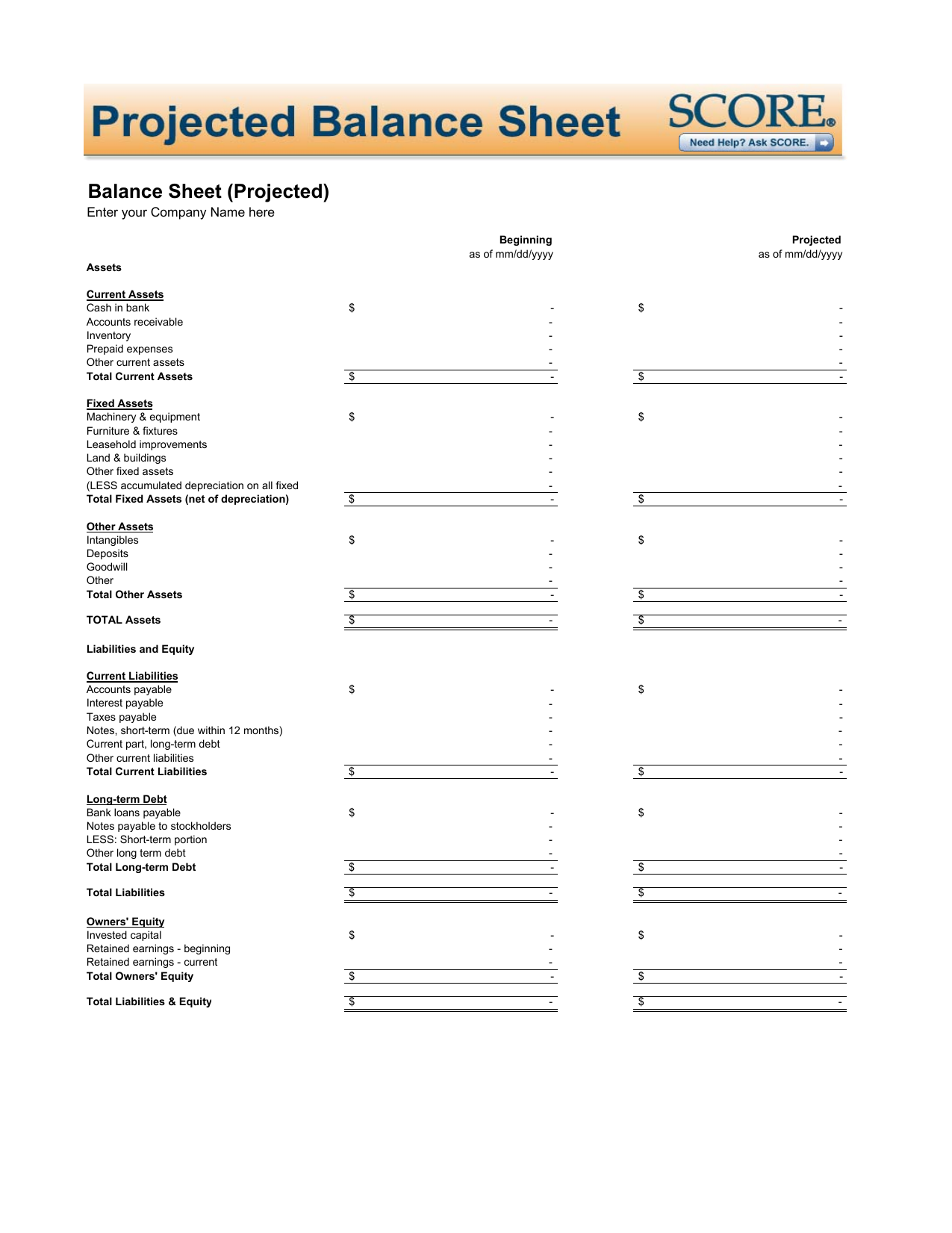

Are your customers paying your invoices? Do you have enough to cover your bills and repay debts? The balance sheet can help you understand all of this. The balance sheet can help you easily identify patterns, especially in accounts receivable and accounts payable.

When you use a balance sheet to track your finances, you are better able to find hidden costs or roadblocks, reduce expenses, and maximize profits. They are used in order to make smart business decisions for both short-term and long-term success. Business owners use financial statements to monitor the financial performance of the company and communicate this to potential investors. For example, the cash balance that appears on the balance sheet is the ending balance used in the cash flow statement. The balance sheet provides a snapshot of information that is linked to both the cash flow and income statements. The balance sheet, together with the income statement and cash flow statement, are key financial reports for any business. In the simplest terms, the balance sheet subtracts what you owe from what you own to calculate your business’s net worth. The balance sheet details what a business owns (current assets), what it owes (total liabilities), and its worth (shareholder or owner’s equity) at a specific point in time, such as the start date or end date of a fiscal year.

0 kommentar(er)

0 kommentar(er)